PJSC ALMAR –Arctic Diamonds (hereinafter referred to as the Company or ALMAR) reports the main results of operations for the 3rd quarter of 2023, including the results of the activities of the subsurface user in its composition LLC AGK (together, the ALMAR Group).

The State commission for mineral reserves (GKZ) approved a Feasibility study (FS) of the temporary exploration conditions of the placer diamond deposit of the Beenchimee river (license YAKU 05120 KP). The volume of balance reserves of diamonds amounted to 455.9 thousand carats. In the reserves contour, gold reserves were also calculated as an associated component in the amount of 17.4 kg.

The forecast diamond resources within the boundaries of the Beenchimee site were: in the P1 category -1284 thousand carats, in the P2 category – 515 thousand carats according to Russian mineral classification*. The total volume of reserves and forecast resources of diamonds from this deposit increased by 32% compared to the estimate in the exploration project in 2017, from 1.705 million to 2.2549 million carats.

ALMAR Group continued to carry out exploration work on poorly explored areas of both licensed subsurface areas according to production plans. In the 3rd quarter of 2023, core samples of the Khatystakh site were processed at a concentration factory maintained by ALMAR specialists. The Company plans to complete the testing of pit and core samples from both sites, as well as complete drilling operations for the 2022-2023 season at the Khatystakh site in the 4th quarter of 2023.

The financing was carried out on schedule, which ensured the continuous implementation of exploration plans at both sites. Financing throughout the life of the ALMAR Group was carried out at the expense of shareholders’ own funds and borrowed funds raised on market terms. According to the results of three quarters, the Company’s budget execution amounted to 249.6 million rubles (about 2,7 mln USD), which is 21% less than planned. Deviations in production costs are related to the actual amount of work and financing performed.

As a result of the costs of exploration, the amount of intangible exploration assets for the ALMAR Group including PJSC ALMAR and LLC AGK (a subsurface user within the Company), as of September 30, 2023 amounted to 391,468 thousand rubles, (as of 30.06.2023 – 257,875 thousand rubles), which is approximately equal to 4,3 mln USD at the present exchange rate.

The report with the results of the third quarter of 2023 is posted on the Russian version of Company’s website on the page INVESTORS/Disclosure of information (Russian version only).

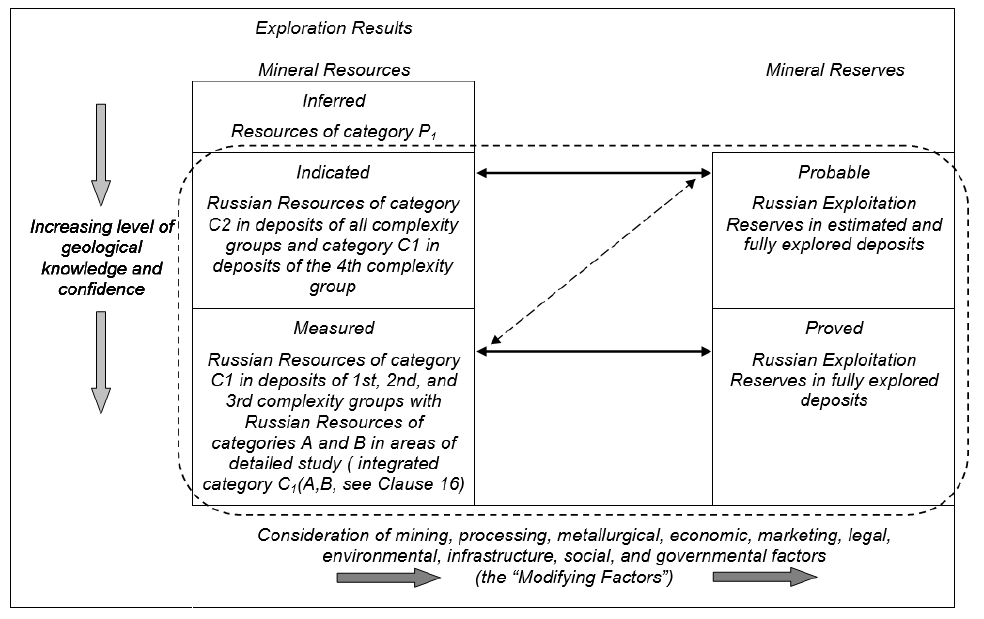

* – Russian mineral classification. A mapping of the Russian and CRIRSCO classifications (categorization) of Mineral Resources and Mineral Reserves as it described at Russian Code for the Public Reporting of Exploration Results, Mineral Resources and Mineral Reserves (NAEN Code), 2014 Edition: